Mastering Profits The Exness Scalping Strategy

Exness Scalping Strategy: A Comprehensive Guide for Traders

Scalping is a popular trading strategy among forex traders seeking to capitalize on small price movements. The Exness Scalping Strategy offers traders an efficient way to make the most of market fluctuations. This article will provide an in-depth look into the components, advantages, risks, and practical applications of the Exness Scalping Strategy, including a unique resource for further reading: Exness Scalping Strategy http://tanieplotowanie.pl/rules-and-limitations-of-take-advantage-of-on-3/.

Understanding Scalping in Forex Trading

Scalping can be defined as a trading strategy that involves making numerous trades throughout the day to exploit tiny price movements. Scalpers, as traders who use this technique are known, often hold positions for just a few seconds to a few minutes. This strategy necessitates a high level of discipline, quick decision-making, and an acute awareness of market trends.

The Framework of Exness Scalping Strategy

The Exness Scalping Strategy is particularly well-suited to the trading conditions offered by Exness, a popular forex broker known for its competitive spreads and fast execution speeds. Traders using this strategy typically focus on the following elements:

- Market Hours: The best time for scalping is during periods of high volatility and market activity, typically around the opening of major market sessions.

- Technical Analysis: Scalpers rely heavily on technical indicators such as moving averages, RSI, and MACD to identify potential entry and exit points.

- Risk Management: Proper risk management techniques, including setting stop-loss orders and calculating potential losses, are crucial for successful scalping.

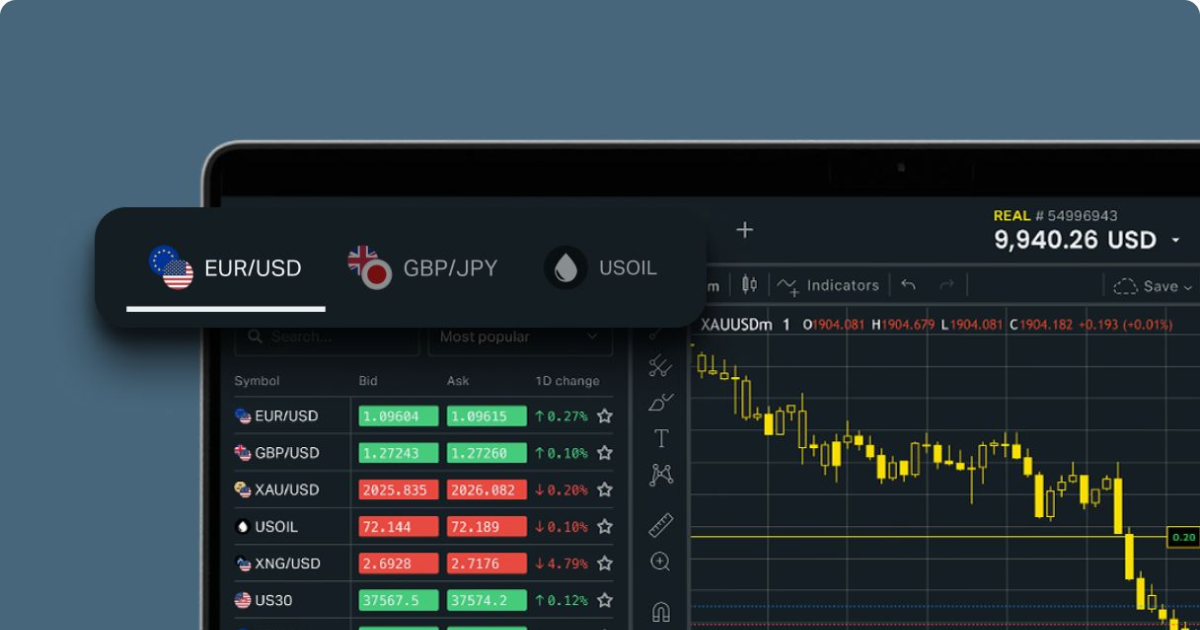

Choosing the Right Currency Pairs

In forex trading, not all currency pairs are suitable for scalping. The Exness Scalping Strategy encourages traders to focus on major currency pairs such as EUR/USD, GBP/USD, and USD/JPY due to their liquidity and narrower spreads. These pairs tend to have tighter bids and offers, allowing scalpers to enter and exit trades with minimal transaction costs.

Using Technical Indicators Effectively

Technical indicators play a significant role in the Exness Scalping Strategy. Here are some commonly used indicators:

- Moving Averages: Traders often use short-term moving averages (such as the 5 and 15-period MAs) to identify trends and potential reversal points.

- Relative Strength Index (RSI): The RSI can help scalpers determine overbought or oversold conditions, providing crucial signals for entry and exit points.

- MACD: The MACD indicator is useful for identifying the momentum of price movements and can signal potential trading opportunities.

Execution Speed and Trading Platforms

When scalping, execution speed is paramount. Exness provides a reliable and fast trading platform, which is essential for scalping. Traders need to ensure that their internet connection is stable and that they are using a platform with quick execution speeds to minimize the risk associated with slippage.

Risk Management in Scalping

Effective risk management cannot be overstated for scalpers. Here are some techniques that should be employed:

- Setting Stop-Loss Orders: Always set a stop-loss order to limit potential losses and protect your capital.

- Risk-to-Reward Ratio: Aim for a favorable risk-to-reward ratio, even in scalping. A common guideline is to have a ratio of at least 1:2.

- Position Sizing: Consider your account size and the percentage of capital you are willing to risk per trade. It’s generally advised to risk no more than 1-2% of your total trading capital on a single trade.

The Psychological Aspect of Scalping

Scalping can be an emotionally taxing strategy due to the rapid decision-making involved. Traders must cultivate a strong mental state to avoid falling prey to greed and fear. Maintaining discipline and sticking to predefined trading plans is crucial for overcoming psychological obstacles in the scalping approach.

Conclusion

The Exness Scalping Strategy provides a framework for traders looking to make quick profits from small price movements in the forex market. Understanding the intricacies of this method, including the importance of market timing, technical analysis, and proper risk management, can bolster a trader’s success rate. With dedication and continuous learning, traders can master the art of scalping while leveraging the benefits offered by platforms like Exness.

As you venture into the world of scalping with Exness, remember that practice makes perfect. Utilize demo accounts to refine your strategy without risking real capital, and continuously analyze your performance to identify areas for improvement.